According to BDSA data, we’re nearing a milestone in cannabis consumption. Across BDSA-tracked markets, nearly 50% of the adult population is consuming cannabis. This is a dramatic increase.

Which makes us wonder: what factors lead to consumer adoption and where is consumer growth happening the fastest? Short answer: In medical markets, it’s all about more lenient rules. The fastest-growing medical markets have broad qualifying conditions, fewer product restrictions, and open licensing. A similar dynamic exists with adult-use markets: States that see big growth tend to have lower prices, big retail footprints, and more lenient licensing rules. But let’s go into more detail. Here’s a run-down of our top four insights on consumer growth.

1. Mature adult-use markets with low pricing and liberal licensing schemes are seeing greatest consumer penetration.

These markets have had higher consumer rates for the past few years, and are nearing 50% of CI respondents claiming past 6-month cannabis use. This increase in consumer penetration is likely a factor of the decreased stigmatization, broader retail access, and increased education on cannabinoids and their effects.

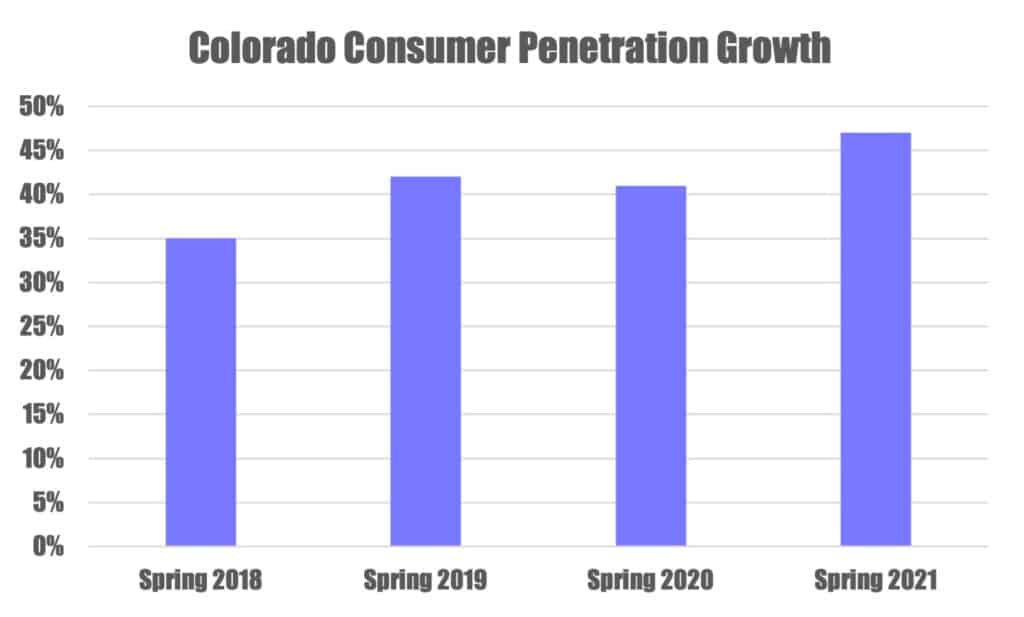

For example, as the oldest adult-use market in the country, Colorado has established a strong retail footprint and has some of the lowest prices for flower in the country, with an average retail price of just $4.51/gram in August 2021. Colorado also has one of the most developed retail landscapes, with 629 active adult-use retail licenses and 423 active medical retail licenses as of August 2021. In Colorado, 47% of consumers reported consuming cannabis in BDSA’s Spring 2021 Consumer Insights survey, up from just 35% in Spring 2018.

Source: BDSA Consumer Insights

Oregon provides another interesting example. This highly developed market has one of the most liberal licensing schemes in the country, which has created a diverse retail landscape and low prices for the consumer. As of August 2021, Oregon was home to 756 active retailers, with relatively low average retail prices for cannabis–the ARP for flower comes in at $5.23/gram in August 2021 (per SKU-based analysis from BDSA Retail Sales Tracking data). In Spring 2021, 45% of those surveyed reported being consumers, up from 26% in Spring 2018. Oregon’s share of rejecters (those who do not consume and would not consider consuming in the future), has also plummeted, from 37% in Spring 2018 to just 26% in Spring 2021.

2. Emerging adult-use markets lag behind in total consumer penetration, but are now seeing faster growth than the earliest markets to launch adult-use sales.

While they lack the absolute number of brands that developed and grew organically over the past 10 years in the most mature markets, developing adult-use markets are seeing the consumer base grow at a faster rate than almost any market.

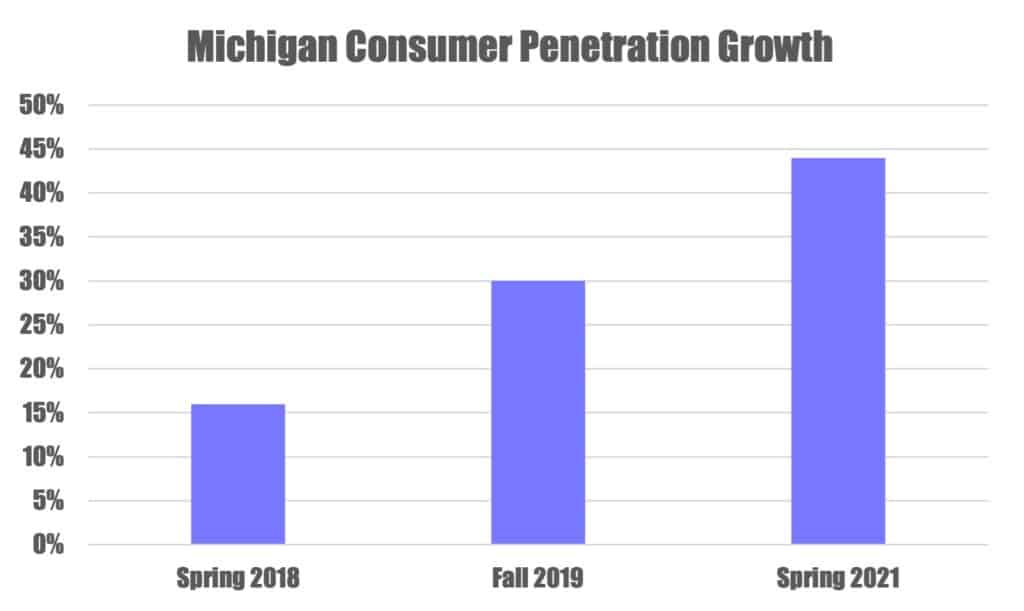

Michigan is a case in point. Since launching adult-use sales in December 2019, Michigan has seen a rapid rise in its consumer penetration. Reported past 6-month consumption went from 16% in Spring 2018, to 30% in Fall 2019, to a whopping 44% in Spring 2021. Even though the adult-use market is relatively young, Michigan’s consumer penetration is already not far behind that of mature markets such as Colorado and Washington, which have consumer penetration of 47% and 46%, respectively.

Michigan is a case in point. Since launching adult-use sales in December 2019, Michigan has seen a rapid rise in its consumer penetration. Reported past 6-month consumption went from 16% in Spring 2018, to 30% in Fall 2019, to a whopping 44% in Spring 2021. Even though the adult-use market is relatively young, Michigan’s consumer penetration is already not far behind that of mature markets such as Colorado and Washington, which have consumer penetration of 47% and 46%, respectively.

Source: BDSA Consumer Insights

Similarly, cannabis consumer penetration in the young Illinois adult-use market has seen a sharp increase since the launch of adult-use cannabis in January 2020. The cannabis consumer population grew from 17% in Spring 2018, to 26% in Spring 2020, to 39% in Spring 2021, not far off from the 45% consumer penetration seen in the much more established California market in Spring 2021. With 32% of respondents in the acceptor category, the Illinois market still has plenty of room to grow its consumer base in the near future.

3. Emerging medical markets with recently relaxed rules see a spike in consumer growth.

Many medical markets are initially stunted by regulations that limit qualifying conditions, product categories, and THC dosage, but these same markets often see consumer patient counts sharply rise with the loosening of these restrictions. While BDSA’s Consumer Insights surveys include all consumers, not just those who are qualified medical patients, the growth of consumer penetration in medical states is indicative of more acceptance of cannabis across the general public, a good sign for legalization proponents in the near future.

For example, one of the more tightly regulated medical programs in the US has gradually relaxed its rules around medical cannabis. Florida now allows more qualifying conditions, more retail locations, and, notably, smokable flower. The state saw a spike in patient counts following the addition of smokable flower in March 2019, with qualified patients growing from 190,646 in early March 2019 to 299,914 in December 2019. The consumer penetration also grew significantly in this period, from 25% in Spring 2019, to 37% in Spring 2021.

For another case study, we turn to Maryland, which has been a hotbed for cannabis industry development, seeing a huge influx of MSO brands and retailers in the past few years. The state also has loosened many of its regulations, now allowing for more qualifying conditions, and as of May 2019, edible products. Maryland says its certified patient count grow from 61,901 in March 2019 to 95,961 in March 2020. The consumer penetration in Maryland has risen from 22% in Spring 2019 to 35% in Spring 2021.

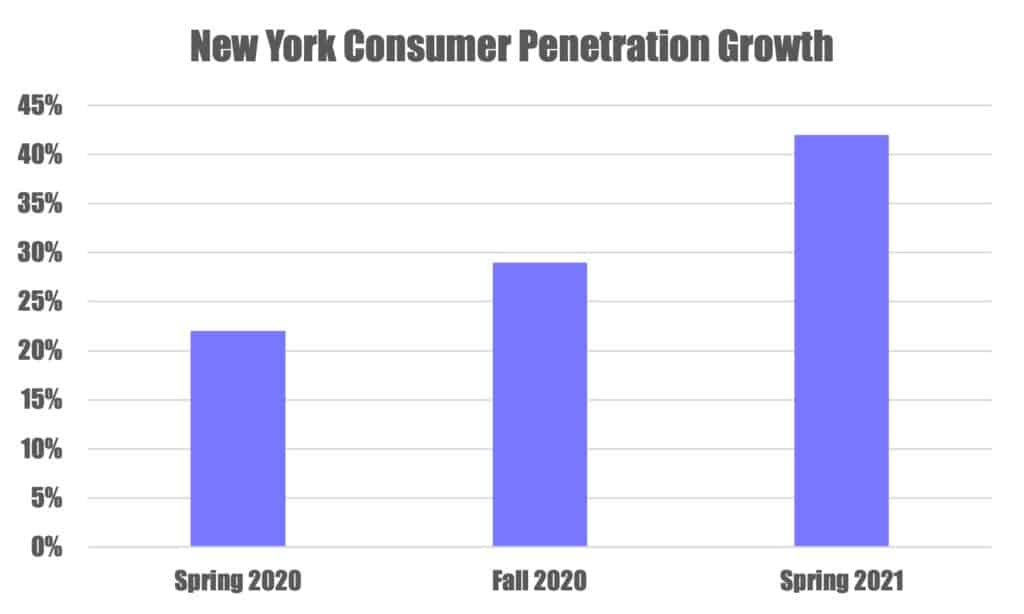

4. New markets with adult-use sales about to start are seeing a boost in percentage of consumer population, even before the launch of sales.

With legal sales set to begin some time in the next year, New York is about to become one of the largest cannabis markets in the country. The long-awaited legalization of adult-use cannabis has coincided with rapid growth in the consumer population, with consumer penetration growing from just 22% in Spring 2020 to 42% in Spring 2021. Even though adult-use sales are not yet active, the passage of decriminalization in late 2019 and legalization of adult-use cannabis in early 2021 have likely had an effect of destigmatizing cannabis use, which in turn helps boost the consumer population.