How big is Florida’s medical cannabis market? How much growth can we expect in the Florida cannabis market in 2021 and 2022? How will Florida’s medical market respond to the addition of adult-use sales? Here we share our latest retail analysis for Florida.

After regulatory adjustments, Florida’s medical market is booming

Since the state legalized medical in 2016, Florida’s cannabis program has seen dramatic reforms, including a broad expansion of qualifying conditions and the legalization of flower and edibles. In early 2021, some legislators attempted to stymie these reforms by putting forth a bill to cap THC content in flower and concentrates, but these efforts had shaky support and subsequently died in the state Senate.

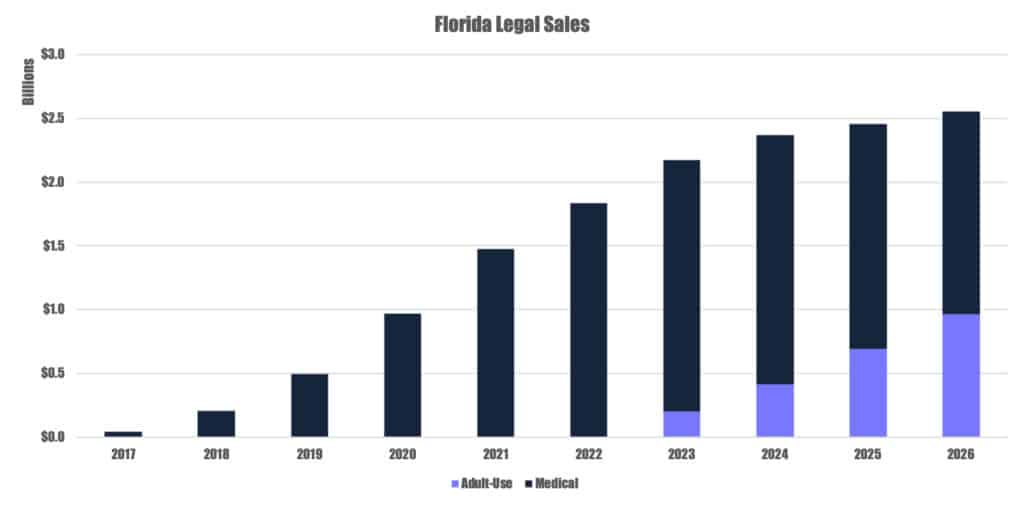

Florida has a highly regulated industry, but this has not stopped it from growing to be the number one medical-only cannabis market in the country. Medical sales totaled just under $1 billion in 2020 and are expected to climb to almost $1.5 billion in 2021. Florida’s medical market is forecast to peak in 2023, then begin to decline as adult-use sales begin, but the medical market is expected to maintain a majority share of legal sales through 2026.

Restrictive licensing currently sets high barrier to entry, but Florida still holds huge opportunity

With only 22 current licenses and stringent compliance requirements for new licenses, setting up business in Florida can be incredibly costly. Despite the high cost of establishing operations in the Sunshine state, the potential for huge profits is obvious, especially once adult-use sales begin. Adult-use sales are forecast to launch in 2023 and bring in $204 million for the year, with medical sales bringing in another $2 billion. Total legal sales are expected to reach $2.6 billion by 2026, with almost $1.6 billion of this coming from medical sales, and adult-use sales making up the remaining $1 billion.

While the current medical market is dominated by large multistate operators, proposed reforms could expand opportunities to smaller businesses in the short term. A case in the state Supreme Court challenging the current licensing structure could result in a ruling allowing for more licenses, including standalone licenses with much less stringent compliance requirements.

For more granular data on retail cannabis sales in Florida, visit BDSA.com.