With an unprecedented pandemic, civil unrest, and an election with potentially huge consequences for the future of legal cannabis, 2020 was a stressful year for many in the industry. Despite these challenges, a number of brands were able to adapt and rack up an impressive sales total for the year. Across some of the most developed markets, growth reached 25% vs. 2019 (across AZ, CA, CO, MD, NV, and OR combined).

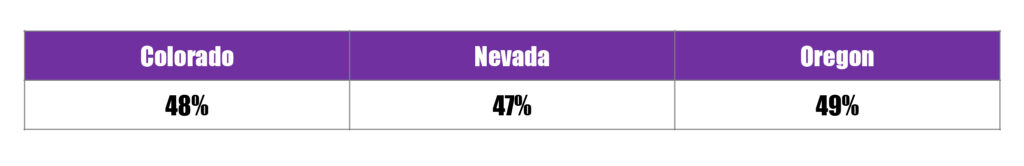

One key factor that played into this success is the increased rates of cannabis consumption across the US, as showcased in BDSA’s most recent Consumer Insights survey. The share of respondents who report recent cannabis consumption increased across the board, with some of the most established states closing in on 50% penetration rates.

% of 21+ Population who are Cannabis Consumers

Could this be an indication of what we could expect as markets mature?

Beyond these most developed markets, penetration increased across the board. Across all states legal for adult-use, the penetration of cannabis consumers increased by +20%. While Colorado, Nevada, and Oregon take the lead, usage hovers around 35-40% for all other adult-use markets.

Consumption increases could at least partially be driven by response to the Covid-19 pandemic. When comparing consumer reactions from Q1 vs. Q4 of 2020, 30% more people claimed they were shopping for cannabis products more often on account of COVID-19. BDSA has also observed that 33% of consumers claim their cannabis usage has increased on account of the ongoing pandemic. This isn’t all that surprising–when asked why they were buying more cannabis, people said it was to help them relax and deal with anxiety and stress.

All this said, as consumers have largely adjusted to the demands of the pandemic by the end of Q4 2020, it is likely that the organic growth of consumer share will continue and possibly even accelerate if the pandemic is brought under control in the coming months. Results of the November 2020 election also are likely to lead to a spike in consumer share in the coming months, with Arizona having legalized and launched adult-use sales, and local elections in California having greatly expanded cannabis retail coverage.

Visit BDSA for more detailed coverage of these trends.

Source: BDSA Retail Sales Tracking; BDSA Consumer Insights Wave 7 (Q4 2020)

1 thought on “Cannabis penetration on the rise”

Pingback: Top ten hottest Oregon edibles brands - MJ Brand Insights