From Anchorage to the end of the world: 8 impressive Alaska dispensaries

Checking in on New York’s legal cannabis market with BDSA

From Anchorage to the end of the world: 8 impressive Alaska dispensaries

Checking in on New York’s legal cannabis market with BDSA

Latest

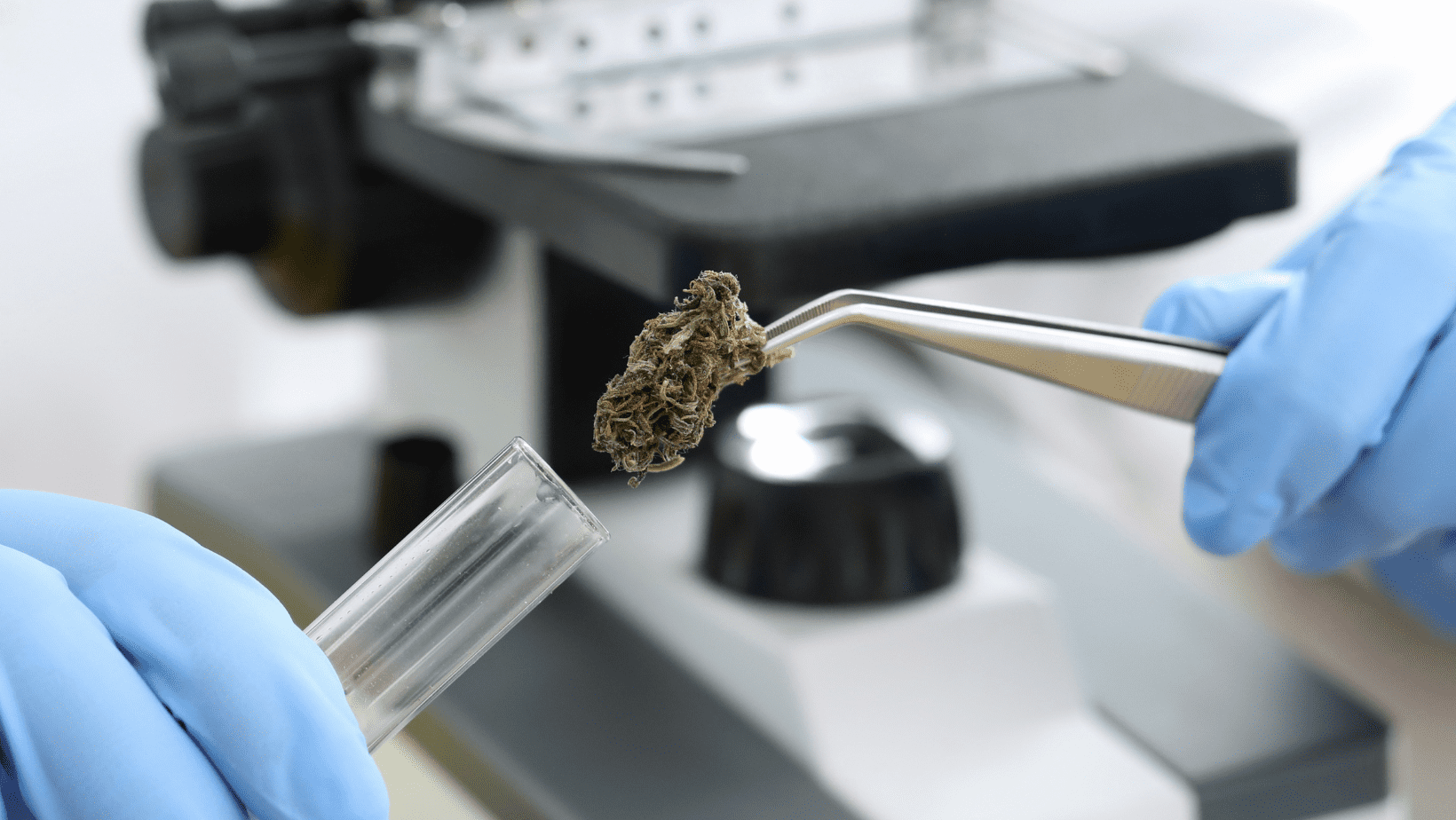

THCV: The next big cannabinoid?

If you’ve heard of THCV at all, it’s likely because of the cannabinoid’s reported ability to suppress the appetite. Munchie-less weed that curbs the appetite is buzzworthy, and cannabis companies have begun to capitalize on the appeal, releasing products such as Canna Slim THCV Gummies and Alpine Dispensary THCv Weight Control Softgels. But THCV’s potential appetite suppressing qualities are not necessarily the most interesting or useful aspects of this cannabinoid. Based on recent crowdsourced research, we’re just starting to learn about the other effects of THCV, which may include improved executive function for neurodivergent people, pain relief, and reduction in the severity and frequency of seizures. Naturally occurring ranges of THCV are typically less than 1% of a cannabis plant’s total weight, making it a relatively rare cannabinoid. While most products on the market currently feature THCV as an isolate, it’s clearly worth exploring the difference between how THCV functions as an isolate versus within the entourage effect of whole plant formulas. So far there’s little formal research on THCV and the entourage effect, but some growers are stepping up and using crowd-sourcing to further our understanding of the potential benefits of this rare cannabinoid. While searching for plants with

BDSA brand insights: Best-selling brands in smaller categories… sublingual edition

When evaluating the cannabis product landscape, it can be too easy to focus on cannabis form factors that make up the biggest shares of legal sales. With the largest inhalable product categories (flower, concentrates and pre-rolled joints) bringing in ~83 percent of dollar sales across BDSA-tracked markets in 2022, one may overlook smaller categories like sublinguals, which made up <1 percent of total dollar sales in 2022. But these smaller-but-still-mighty categories are very much worth exploring for retailers, brands and consumers. Why? Because becoming a dominant brand in a smaller category can be even more fruitful than fighting for a leading position in a larger, but more saturated sector of the industry. The sublingual category is especially worth considering when we look at emerging medical markets in states like Pennsylvania, which has a huge potential market size, but regulatory limitations that restrict some of the more popular ingestible form factors, such as baked goods and gummies. BDSA’s best-selling sublingual brands Papa & Barkley California cannabis brand Papa & Barkley is no stranger to the sublingual game, with the brand making up a 13 percent share of sublingual sales in California in 2022. Bringing in almost $1.8 million for December 2022

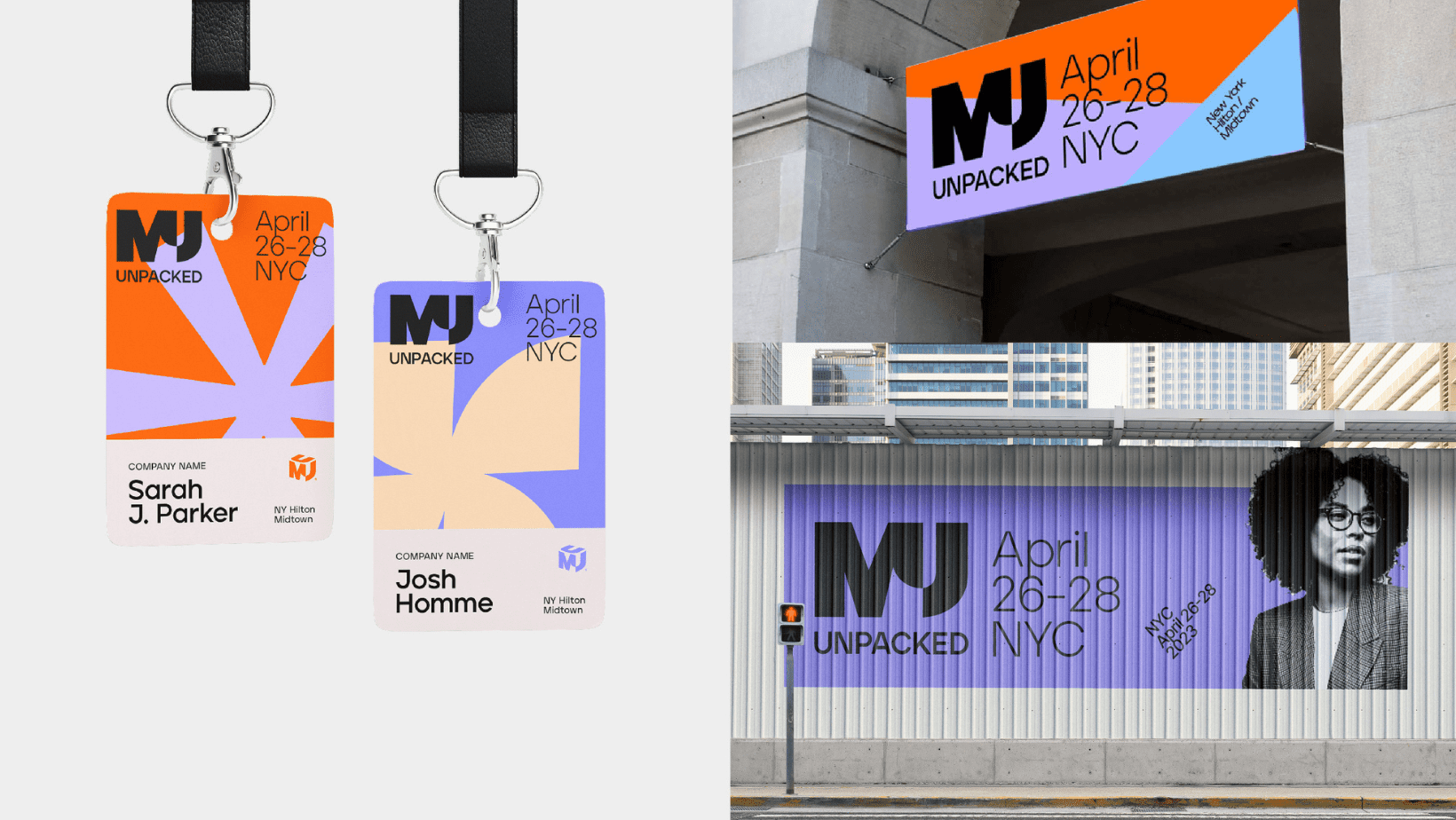

Grateful Valley Farm’s tireless venture into the New York cannabis scene

Passionate people are often characterized as working “tirelessly.” But in reality, the time and energy we devote to our passions can be exhausting. No one knows this better than the very passionate (and very tired) Tess Interlicchia. As Founder and CEO of Grateful Valley Farm, and one of the first licensed marijuana cultivators in New York State, Interlicchia has spent the last year navigating a rapidly-growing industry that is still figuring itself out. “It’s nonstop, the regulations are changing constantly. It’s a full time job alone just reading up on everything,” says Interlicchia. Grateful Valley is situated on seventy-two acres of land which has been an organic farm for decades. Interlicchia purchased the property in 2019 to grow hemp and planned from the start to grow cannabis once it became legal. She applies regenerative farming practices and grows weed the good old fashioned way. “I love outdoor, I don’t ever want to go indoor. It’s just ground grown. It allows the plant to do what it’s supposed to do,” she says. When applications opened up for Adult-Use Conditional Cultivator licenses last March, Interlicchia found the process of paperwork relatively painless and, within about a month, was one of more than

The Medicine Wheel, Toronto’s unlicensed Indigenous cannabis chain, keeps on turnin’

Canada has legal weed, but not every seller is opting into the system. Some Indigenous-run pot shops reject the colonial licensing regime, arguing that what most know as “Canada” is still their land — and they should have jurisdiction over it. “This store is operated by sovereign people on sovereign land,” reads the window of the Mississaugas of the Credit Medicine Wheel on Toronto’s St. Clair Avenue. “We are exercising our constitutional and inherent rights.” It’s a strategy that may run up against municipal enforcement, which has promised to “take action” against unlicensed shops. The stores are “seed-to-sale Indigenous,” they say, meaning everyone from the grower to the cashier is Indigenous. Customers can walk in off the street and pick up a joint or some flower, just like any other pot shop. The inside is clean and professional, and the budtenders are helpful and knowledgeable. The stores often run specials of two ounces for $100. Unlike other pot shops, some Indigenous-run stores sell higher-dose edibles than the 10mg federal maximum — a limit seen as far too low by the industry (and many consumers). And they freely advertise cannabis as medicine, which is also not allowed under Canadian law. Ken

BDSA brand insights: Top five disposable vape brands

Since the opening of the first legal cannabis market, vapes have made up a significant share of product sales. In 2022, BDSA data shows that vapes brought in 26 percent of dollar sales across tracked markets, making the category the second best-selling cannabis form factor after flower. But not all vapes are created equal. The category includes vape cartridges, which are concentrate units sold independently of a reusable vaporizer battery, as well as disposable vapes, an all-in-one battery and concentrate product. Vape cartridges make up the vast majority of the category, but disposable vapes are on the rise. Even just from the beginning of 2022 to the end of the year (Q1 2022 to Q4 2022), disposable vapes grew from a 13 percentshare of vape dollar sales to a 17 percentshare of vape dollar sales across BDSA-tracked markets. As with any sector of the cannabis industry, winning in the disposable vape space takes meticulous planning and a data-based strategy, so our congratulations to the top-selling disposable vape brands across BDSA-tracked markets.(AZ, CA, CO, FL, IL, MA, MD, MI, MO, NV, NJ, NY, OR, PA) Before we get into the list, let’s set the stage with some background on the disposable

Is California lounging on the legal cannabis industry?

The bloom is off the bud in California. The much-touted retail cannabis industry, once buoyed by good intentions and high expectations, has turned out to be a great green goose that can’t quite squeeze out the golden egg.

Years after legalization, this Canadian black market pot shop endures

CAFE (Cannabis And Fine Edibles) started in 2016 and has four locations across Toronto. Despite governments trying for years to shut it down, they appear to be chugging along just fine.

BDSA cannabis insights: Top trends in the gummy edible category

BDSA gives us insights to stay at the head of the pack in a competitive category like gummy edibles.

What does it take to make it big in the cannabis industry? We ask Wana’s Nancy Whiteman

When Nancy Whiteman was a pot-smoking teenager, she never dreamed of a future where THC would be legal. So it stands to reason she also never suspected that she’d be the CEO and co-founder of one of the most famous cannabis brands in the world.

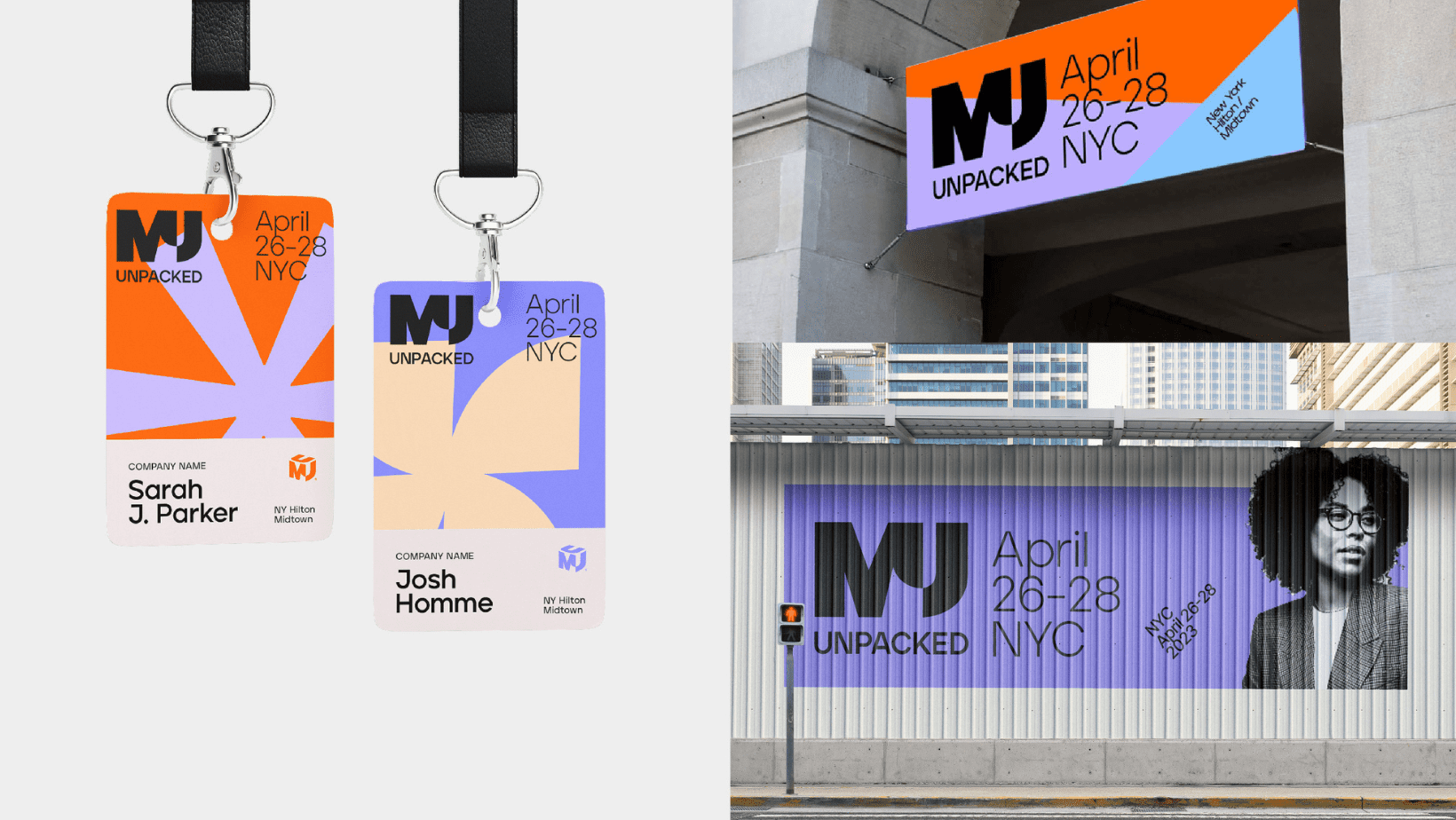

MJ Unpacked unveils fresh new look ahead of New York event

As the official publication of MJ Unpacked, we’re pleased to report that our flagship event is returning to the New York Hilton Midtown with a fresh new look through a partnership with ABC Brand / Design.

THCV: The next big cannabinoid?

If you’ve heard of THCV at all, it’s likely because of the cannabinoid’s reported ability to suppress the appetite. Munchie-less weed that curbs the appetite is buzzworthy, and cannabis companies have begun to capitalize on the appeal, releasing products such as Canna Slim THCV Gummies and Alpine Dispensary THCv Weight Control Softgels. But THCV’s potential appetite suppressing qualities are not necessarily the most interesting or useful aspects of this cannabinoid. Based on recent crowdsourced research, we’re just starting to learn about the other effects of THCV, which may include improved executive function for neurodivergent people, pain relief, and reduction in the severity and frequency of seizures. Naturally occurring ranges of THCV are typically less than 1% of a cannabis plant’s total weight, making it a relatively rare cannabinoid. While most products on the market currently feature THCV as an isolate, it’s clearly worth exploring the difference between how THCV functions as an isolate versus within the entourage effect of whole plant formulas. So far there’s little formal research on THCV and the entourage effect, but some growers are stepping up and using crowd-sourcing to further our understanding of the potential benefits of this rare cannabinoid. While searching for plants with

BDSA brand insights: Best-selling brands in smaller categories… sublingual edition

When evaluating the cannabis product landscape, it can be too easy to focus on cannabis form factors that make up the biggest shares of legal sales. With the largest inhalable product categories (flower, concentrates and pre-rolled joints) bringing in ~83 percent of dollar sales across BDSA-tracked markets in 2022, one may overlook smaller categories like sublinguals, which made up <1 percent of total dollar sales in 2022. But these smaller-but-still-mighty categories are very much worth exploring for retailers, brands and consumers. Why? Because becoming a dominant brand in a smaller category can be even more fruitful than fighting for a leading position in a larger, but more saturated sector of the industry. The sublingual category is especially worth considering when we look at emerging medical markets in states like Pennsylvania, which has a huge potential market size, but regulatory limitations that restrict some of the more popular ingestible form factors, such as baked goods and gummies. BDSA’s best-selling sublingual brands Papa & Barkley California cannabis brand Papa & Barkley is no stranger to the sublingual game, with the brand making up a 13 percent share of sublingual sales in California in 2022. Bringing in almost $1.8 million for December 2022

Grateful Valley Farm’s tireless venture into the New York cannabis scene

Passionate people are often characterized as working “tirelessly.” But in reality, the time and energy we devote to our passions can be exhausting. No one knows this better than the very passionate (and very tired) Tess Interlicchia. As Founder and CEO of Grateful Valley Farm, and one of the first licensed marijuana cultivators in New York State, Interlicchia has spent the last year navigating a rapidly-growing industry that is still figuring itself out. “It’s nonstop, the regulations are changing constantly. It’s a full time job alone just reading up on everything,” says Interlicchia. Grateful Valley is situated on seventy-two acres of land which has been an organic farm for decades. Interlicchia purchased the property in 2019 to grow hemp and planned from the start to grow cannabis once it became legal. She applies regenerative farming practices and grows weed the good old fashioned way. “I love outdoor, I don’t ever want to go indoor. It’s just ground grown. It allows the plant to do what it’s supposed to do,” she says. When applications opened up for Adult-Use Conditional Cultivator licenses last March, Interlicchia found the process of paperwork relatively painless and, within about a month, was one of more than

The Medicine Wheel, Toronto’s unlicensed Indigenous cannabis chain, keeps on turnin’

Canada has legal weed, but not every seller is opting into the system. Some Indigenous-run pot shops reject the colonial licensing regime, arguing that what most know as “Canada” is still their land — and they should have jurisdiction over it. “This store is operated by sovereign people on sovereign land,” reads the window of the Mississaugas of the Credit Medicine Wheel on Toronto’s St. Clair Avenue. “We are exercising our constitutional and inherent rights.” It’s a strategy that may run up against municipal enforcement, which has promised to “take action” against unlicensed shops. The stores are “seed-to-sale Indigenous,” they say, meaning everyone from the grower to the cashier is Indigenous. Customers can walk in off the street and pick up a joint or some flower, just like any other pot shop. The inside is clean and professional, and the budtenders are helpful and knowledgeable. The stores often run specials of two ounces for $100. Unlike other pot shops, some Indigenous-run stores sell higher-dose edibles than the 10mg federal maximum — a limit seen as far too low by the industry (and many consumers). And they freely advertise cannabis as medicine, which is also not allowed under Canadian law. Ken

BDSA brand insights: Top five disposable vape brands

Since the opening of the first legal cannabis market, vapes have made up a significant share of product sales. In 2022, BDSA data shows that vapes brought in 26 percent of dollar sales across tracked markets, making the category the second best-selling cannabis form factor after flower. But not all vapes are created equal. The category includes vape cartridges, which are concentrate units sold independently of a reusable vaporizer battery, as well as disposable vapes, an all-in-one battery and concentrate product. Vape cartridges make up the vast majority of the category, but disposable vapes are on the rise. Even just from the beginning of 2022 to the end of the year (Q1 2022 to Q4 2022), disposable vapes grew from a 13 percentshare of vape dollar sales to a 17 percentshare of vape dollar sales across BDSA-tracked markets. As with any sector of the cannabis industry, winning in the disposable vape space takes meticulous planning and a data-based strategy, so our congratulations to the top-selling disposable vape brands across BDSA-tracked markets.(AZ, CA, CO, FL, IL, MA, MD, MI, MO, NV, NJ, NY, OR, PA) Before we get into the list, let’s set the stage with some background on the disposable

Is California lounging on the legal cannabis industry?

The bloom is off the bud in California. The much-touted retail cannabis industry, once buoyed by good intentions and high expectations, has turned out to be a great green goose that can’t quite squeeze out the golden egg.

Years after legalization, this Canadian black market pot shop endures

CAFE (Cannabis And Fine Edibles) started in 2016 and has four locations across Toronto. Despite governments trying for years to shut it down, they appear to be chugging along just fine.

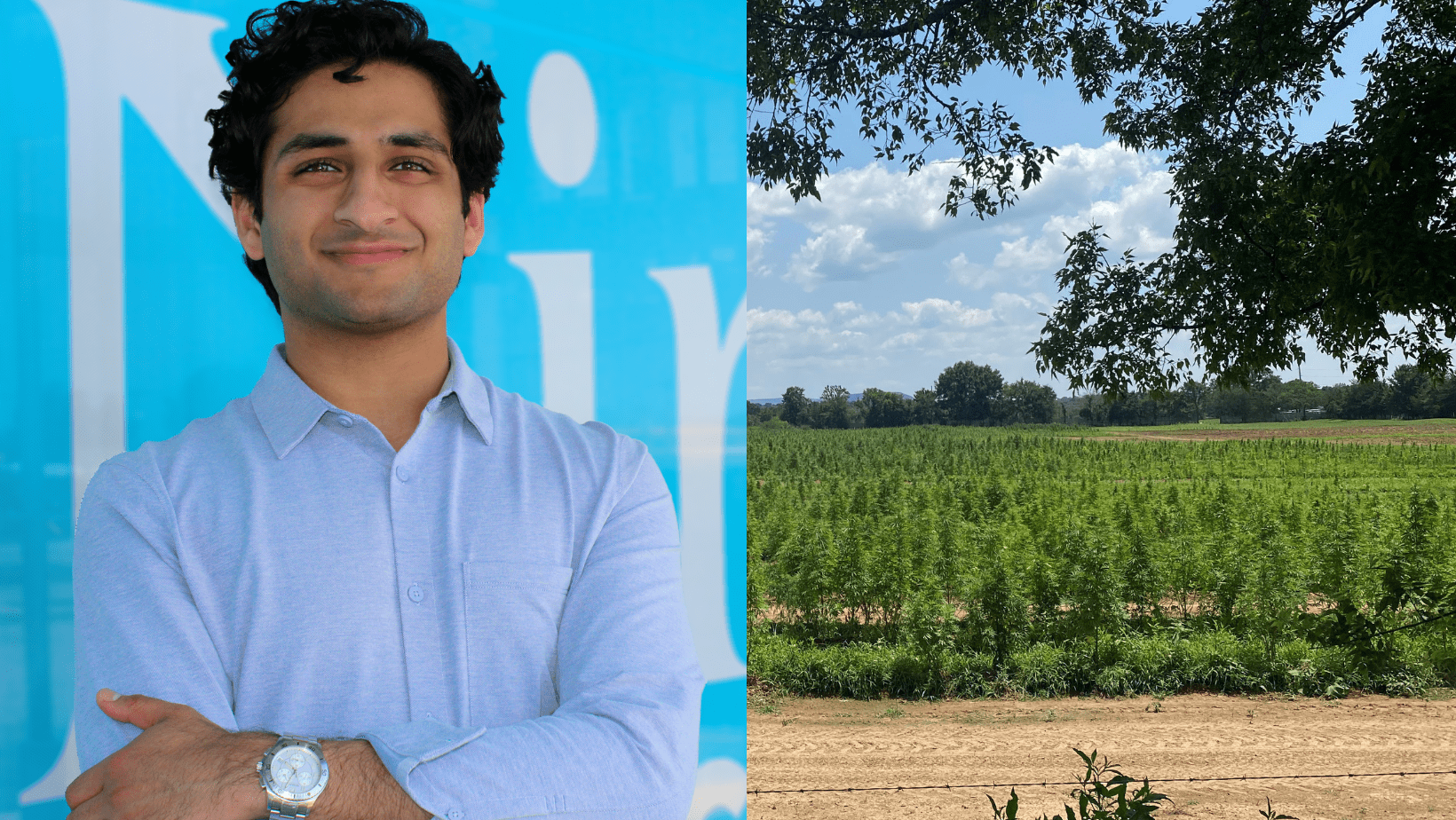

BDSA cannabis insights: Top trends in the gummy edible category

BDSA gives us insights to stay at the head of the pack in a competitive category like gummy edibles.

What does it take to make it big in the cannabis industry? We ask Wana’s Nancy Whiteman

When Nancy Whiteman was a pot-smoking teenager, she never dreamed of a future where THC would be legal. So it stands to reason she also never suspected that she’d be the CEO and co-founder of one of the most famous cannabis brands in the world.

MJ Unpacked unveils fresh new look ahead of New York event

As the official publication of MJ Unpacked, we’re pleased to report that our flagship event is returning to the New York Hilton Midtown with a fresh new look through a partnership with ABC Brand / Design.

What does it take to make it big in the cannabis industry? We ask Wana’s Nancy Whiteman

When Nancy Whiteman was a pot-smoking teenager, she never dreamed of a future where THC would be legal. So it stands to reason she also never suspected that she’d be the CEO and co-founder of one of the most famous cannabis brands in the world.

Family ayrlooms: Gen 5 Labs’ evolution from apple orchards to cannabis beverages

Most cannabis brands aren’t attached to a mainstream business that dates back more than 100 years. But Gen 5 Labs’ ayrloom brand is just that. Here’s the scoop.

Nike John would like to thank you for flying with The Heritage Club

Being both young and Black, Boston’s Nike John is part of two groups sorely underrepresented in dispensary ownership – and she doesn’t take it lightly.

From Anchorage to the end of the world: 8 impressive Alaska dispensaries

We haven’t been keeping a close watch on beautiful Alaska. So, here are eight Alaskan dispensaries doing fascinating things in The Last Frontier.

8 biblically-correct Valentine’s Day cannabis products

You’ve heard of biblically-correct angels — now get ready for biblically-correct Valentine’s Day cannabis products.

Mycological magic: How a group of horticulturists are helping farms grow better weed

Nutrient deficiencies, root rot, and mildew, oh my! Here’s how Mycopyhte Solutions promises to help cultivators grow better weed.

How Oklahoma’s Nirvana Group blossomed ahead of adult-use legislation

What started as a small tobacco shop is now a vertically integrated cannabis company on the cusp of exploding as Oklahoma voters decide whether to legalize adult-use marijuana during a special election in March.

Celebrity brands can learn a thing or two about authenticity from JuJu Royal’s Michigan launch

When Julian Marley, son of the iconic reggae pioneer and arguably the most famous rastafarian ever, launched a cannabis brand, it just made sense.

From “Just say no” to CEO: How Coast’s Angela Brown built a clean brand out of her kitchen

Angela Brown never thought she’d use cannabis, let alone sell it. Today she makes products with one consumer in mind — herself.

Happy staffers? William McKenzie on building a win-win business model in Michigan

Meet William McKenzie of Left Coast Holdings, a proud supporter of cannabis workers’ unions. Here’s how he’s built a successful and supportive business model.

BDSA brand insights: Best-selling brands in smaller categories… sublingual edition

When evaluating the cannabis product landscape, it can be too easy to focus on cannabis form factors that make up the biggest shares of legal sales. With the largest inhalable product categories (flower, concentrates and pre-rolled joints) bringing in ~83 percent of dollar sales across BDSA-tracked markets in 2022, one may overlook smaller categories like sublinguals, which made up <1 percent of total dollar sales in 2022. But these smaller-but-still-mighty categories are very much worth exploring for retailers, brands and consumers. Why? Because becoming a dominant brand in a smaller category can be even more fruitful than fighting for a leading position in a larger, but more saturated sector of the industry. The sublingual category is especially worth considering when we look at emerging medical markets in states like Pennsylvania, which has a huge potential market size, but regulatory limitations that restrict some of the more popular ingestible form factors, such as baked goods and gummies. BDSA’s best-selling sublingual brands Papa & Barkley California cannabis brand Papa & Barkley is no stranger to the sublingual game, with the brand making up a 13 percent share of sublingual sales in California in 2022. Bringing in almost $1.8 million for December 2022

The Medicine Wheel, Toronto’s unlicensed Indigenous cannabis chain, keeps on turnin’

Canada has legal weed, but not every seller is opting into the system. Some Indigenous-run pot shops reject the colonial licensing regime, arguing that what most know as “Canada” is still their land — and they should have jurisdiction over it. “This store is operated by sovereign people on sovereign land,” reads the window of the Mississaugas of the Credit Medicine Wheel on Toronto’s St. Clair Avenue. “We are exercising our constitutional and inherent rights.” It’s a strategy that may run up against municipal enforcement, which has promised to “take action” against unlicensed shops. The stores are “seed-to-sale Indigenous,” they say, meaning everyone from the grower to the cashier is Indigenous. Customers can walk in off the street and pick up a joint or some flower, just like any other pot shop. The inside is clean and professional, and the budtenders are helpful and knowledgeable. The stores often run specials of two ounces for $100. Unlike other pot shops, some Indigenous-run stores sell higher-dose edibles than the 10mg federal maximum — a limit seen as far too low by the industry (and many consumers). And they freely advertise cannabis as medicine, which is also not allowed under Canadian law. Ken

BDSA brand insights: Top five disposable vape brands

Since the opening of the first legal cannabis market, vapes have made up a significant share of product sales. In 2022, BDSA data shows that vapes brought in 26 percent of dollar sales across tracked markets, making the category the second best-selling cannabis form factor after flower. But not all vapes are created equal. The category includes vape cartridges, which are concentrate units sold independently of a reusable vaporizer battery, as well as disposable vapes, an all-in-one battery and concentrate product. Vape cartridges make up the vast majority of the category, but disposable vapes are on the rise. Even just from the beginning of 2022 to the end of the year (Q1 2022 to Q4 2022), disposable vapes grew from a 13 percentshare of vape dollar sales to a 17 percentshare of vape dollar sales across BDSA-tracked markets. As with any sector of the cannabis industry, winning in the disposable vape space takes meticulous planning and a data-based strategy, so our congratulations to the top-selling disposable vape brands across BDSA-tracked markets.(AZ, CA, CO, FL, IL, MA, MD, MI, MO, NV, NJ, NY, OR, PA) Before we get into the list, let’s set the stage with some background on the disposable

Is California lounging on the legal cannabis industry?

The bloom is off the bud in California. The much-touted retail cannabis industry, once buoyed by good intentions and high expectations, has turned out to be a great green goose that can’t quite squeeze out the golden egg.

Years after legalization, this Canadian black market pot shop endures

CAFE (Cannabis And Fine Edibles) started in 2016 and has four locations across Toronto. Despite governments trying for years to shut it down, they appear to be chugging along just fine.

BDSA cannabis insights: Top trends in the gummy edible category

BDSA gives us insights to stay at the head of the pack in a competitive category like gummy edibles.

BDSA cannabis insights: A closer look at the infused pre-roll category

Infused pre-rolls have seen a boost in sales across multiple markets. BDSA breaks it down further, examining the ins and outs of the infused pre-roll category.

Best in the northwest? NW Leaf Bowl highlights top players in Washington weed

Northwest Leaf has occupied local dispensary news stands for as long as I can remember. So when I got the opportunity to attend the inaugural NW Leaf Bowl, I was eager to see just what this magazine had to offer. Here’s the full recap.

Notable newsmakers: The hottest cannabis brands of 2022, according to earned media

As brands and cannabis PR agents well know, it’s tough to get media coverage. Which cannabis companies are winning this race? Pioneer Intelligence shares the data.

Pioneer Intelligence dropped a list of the top cannabis brands on social media and the results might surprise you

Surviving social media? Despite tight regulations in and beyond Zuckerberg’s monopoly, some brands’ strategies are prevailing, providing them with an engaged social media audience at their fingertips.

MJ Unpacked unveils fresh new look ahead of New York event

As the official publication of MJ Unpacked, we’re pleased to report that our flagship event is returning to the New York Hilton Midtown with a fresh new look through a partnership with ABC Brand / Design.

ICYMI: This week in weed news 2/24

Friday’s arrived and we’ve got another roundup of the week’s top headlines.

ICYMI: This week in weed news 2/17

It’s Friday already and we’ve got another round of cannabis news you may have missed. From new dispensary openings to steps toward equity, here are some of this week’s top headlines.

Twitter becomes the first major social media platform to allow cannabis advertisements

It’s a big day for cannabis marketers. Effective immediately, social media giant Twitter will allow cannabis companies to advertise for CBD, THC, and cannabis-related products like delivery services, testing labs, and grow technology in the United States.

Welcome to the future: Colorado debuts another cannabis vending machine

Colorado’s latest weed-stocked machine won’t be “out of odor” any time soon.

ICYMI: This week in weed news 2/10

Friday’s here and you know what that means: time for a cannabis news roundup. Here are some of the headlines you may have missed this week.

Vermont calls for a state-run testing lab following sales of contaminated cannabis

Turns out it’s not good to smoke fungicides. The Vermont Cannabis Control Board is now calling for a state-run testing lab.

ICYMI: This week in weed news 2/3

January’s come and gone and with it came lots of cannabis news. Didn’t keep up at the end? We’ve rounded up some of the top news from this week to keep you in the know before the weekend.

What’s on the table? Senators to meet and discuss cannabis legislation today

At this point, we know not to read too much into yet another discussion about cannabis reform. With that said, we’re still curious to know what might go down in today’s meeting with Senate Majority Leader Chuck Schumer and other Democratic senators.

California officials ask attorney general for opinion on the risks of interstate cannabis commerce

We’re not cruising yet. California Governor Gavin Newsom signed a bill approving interstate commerce for cannabis back in September, but officials are seeking legal opinions before moving forward with the plan.

Raising the bar in retail: On strategic expansion and creative community building with Hashtag Cannabis

We catch up with the Hashtag team to discuss strategic expansions, savvy socials, and creative community building.

Winning in Washington weed: Shannon Vetto’s journey from consultant to CEO

Shannon Vetto didn’t get into the cannabis industry because she likes smoking weed. She got into it because she thought that with her background in the investment industry she could help marijuana businesses achieve their full potential.

Persevering product categories: Where BDSA sees strong growth in time of continued price compression

We may be facing continued price compression in the cannabis industry, but BDSA has rounded up some product categories that continue to see strong growth despite market conditions.

Standing out in the Golden State: How Purple Lotus transcends transactional retail

When dispensaries wear their cannabis-loving hearts on their sleeve, they offer customers an experience that transcends transactional retail. Here’s how Purple Lotus makes it happen.

8 products with festive holiday marketing strategies

It’s the most wonderful time of the year…to analyze festive marketing strategies. Here are eight limited-edition drops or holiday-centric items that caught our attention this season.

New product roundup: Fall 2022

From veteran-centric new products to gummies with a purpose, here are the top new products that caught our eyes this fall.

6 Michigan dispensaries that stand out from the rest

Michigan is the U.S. state with the ninth-most dispensaries per capita. Not bad for having legalized recreational weed in 2018. Here are six that caught our eyes.

7 essential strategies to find profitable cannabis retail properties

How do you find the right location for your dispensary? We’ve got seven tips to make your efforts profitable.

5 companies with spooktacular Halloween marketing

Halloween is almost upon us, and some brands are stepping up their marketing strategies for the spooky season. Read on to learn how savvy companies are marketing everything from “scary” pre-rolls to real-life collaborative events.

Realistically speaking, when is SAFE Banking going to pass? Industry leaders say it’s in reach

Industry leaders say the SAFE Banking Act is within reach — but Dems need to hurry.