Once a niche product aimed at the discerning dabber, live resin concentrates are becoming more popular and taking up a greater share of concentrate sales in legal markets. While all concentrate products are trending more toward live resin inputs, live resin products have grown their share of dabbable concentrates much more than they have with vapes. This is the case even as vape’s share of total sales has grown to rival that of flower in the largest legal cannabis markets.

According to BDSA’s Retail Sales Tracking, live resin already accounted for 50% of dabbable concentrate dollar sales in California in the last eight months of 2018. The next largest shares were held by wax (11% of dabbable dollar sales) and shatter (9% of dabbable dollar sales). In the first 5 months of 2021, the subcategory mix shifted significantly, with live resin now making up 61% of dabbable dollar sales in California. Wax slightly shrunk its share of dollar sales to 9%, while shatter fell to 4%.

In 2018, the bulk of vape sales in California were distillate cartridges, with 65% of dollar sales, and oil cartridges, with 19% of dollar sales. Live resin cartridges held a much smaller share of the vape category, with about 2% of dollar sales. Fast forward to 2021. Looking at data from the first five months of the year, we see that live resin cartridges jumped to 33% of vape dollar sales, while live resin disposable vapes made up about 3% of vape dollar sales. Distillate cartridges maintained a dominant share of the subcategory mix, making up 46% of vape dollar sales in this period.

Retail sales tracking data clearly shows the ascendance of live resin in the concentrate market, but the trend is much more pronounced with dabbables than vapes. Why the difference in share between vapes and dabbables? Do vape consumers really prefer distillate products, the hot dog of the cannabis concentrate world, or are there other reasons for this difference in live resin’s share of category sales? BDSA’s Consumer Insights Survey from Spring 2021 offers a few explanations:

1. Broader popularity of vape products

To put it simply, more people vape. In adult-use states, more respondents in BDSA’s consumer survey report using vape inhalables (45%) than those who report dabbing (22%). Vapes also ranked as the most preferred method of consumption, with 23% of inhalable consumers saying they prefer vaping. By contrast, only 6% of consumers say they prefer dabbing. With this wider consumption of vape products, vapes are more likely to attract new and less discerning consumers.

2. Lower number of live resin vapes than other vape products

According to consumer data, 25% of consumers report that they are more likely to buy a product if it’s from a brand they’ve purchased before. In 2021, BDSA’s retail sales tracking shows 95 brands offering live resin cartridges in California, compared to 138 brands with non-live resin vape cartridge products. Additionally, all top 10 vape products (by dollar sales) in California are distillate cartridges. With this greater availability of non-live resin vape products, consumers are more likely to have used distillate or oil-based vapes in the past, and could be more likely to purchase them in the future.

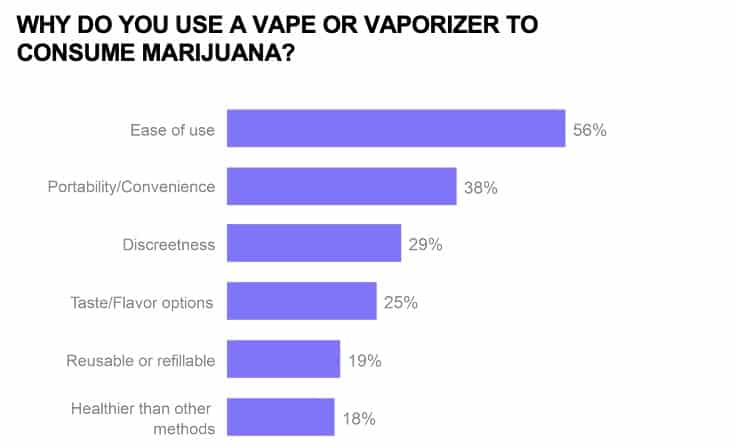

3. Taste and flavor are less important to vape consumers

Consumers report that their top reasons for consuming vapes relate to their ease of use (56%) and convenience (38%), much outweighing those who report that taste/flavor is their reason (25%) for choosing vapes. As taste and flavor are not a primary consideration, consumers are more likely to choose a given vape product based on their price point (which would give an advantage to distillate products) rather than seeking out a premium product such as a live resin vape, where taste and flavor are key upsides.