Since the earliest days of the medical cannabis movement, therapeutic cannabis use has been met with skepticism. Killjoy prohibitionists and cautious doctors have lobbed accusations and implied that medical cannabis is just an excuse by patients to use that Dank Sinatra to fly themselves to the moon, rather than a valuable tool to treat legitimate ailments.

While cannabis undoubtedly provides relief to a wide variety of conditions, there’s also truth to the assumption that medical patients also consume for non-medical reasons. As medical weed becomes mainstream, many patients report consuming cannabis for recreational reasons. Whether a state market is split channel (medical and adult-use) or just medical, BDSA tracks similar form factor preference, consumption dynamics, and category share of total dollar sales.

What percentage of medical patients also consume for recreational reasons?

BDSA’s Consumer tracking (covering every US state and Canadian province) shows that in states with only medical cannabis, respondents report an almost equal split between consuming for recreational/social purposes (68%) and health or medical reasons (67%). When specifically looking at dispensary shoppers in medical-only states, 80% claim to consume for health or medical reasons, while 63% claim to consume for recreational or social occasions. Dispensary shoppers in fully adult-use legal states AND medical-only legal states have similar primary reasons for consuming cannabis. Both groups look to pain relief and a general desire to relax and unwind.

In short, for the majority of cannabis consumers, consumption is multi-faceted and multi-purpose and typically varies by time of day or occasion. In the morning, consumption could be for pain relief, throughout the day for anxiety, in the evening to relax and unwind, and before bed for a sleep aid.

The top five reasons for inhaling

Inhalables, the most preferred product form, are often consumed for functional benefits tied to recreational and health/medical benefits. In medical only markets, the top five reasons for inhaling are:

- Relax and be mellow

- Sleep better

- Manage stress

- Feel peaceful

Do medical patients and adult use consumers prefer different products?

When it comes to products, consumption habits don’t seem to differ much between medical patients and adult use consumers. For example, the product category mix doesn’t look that different when you compare adult-use and medical markets in the same state. Nor is there a huge difference when you compare product choices between an adult use state and a medical-only state.

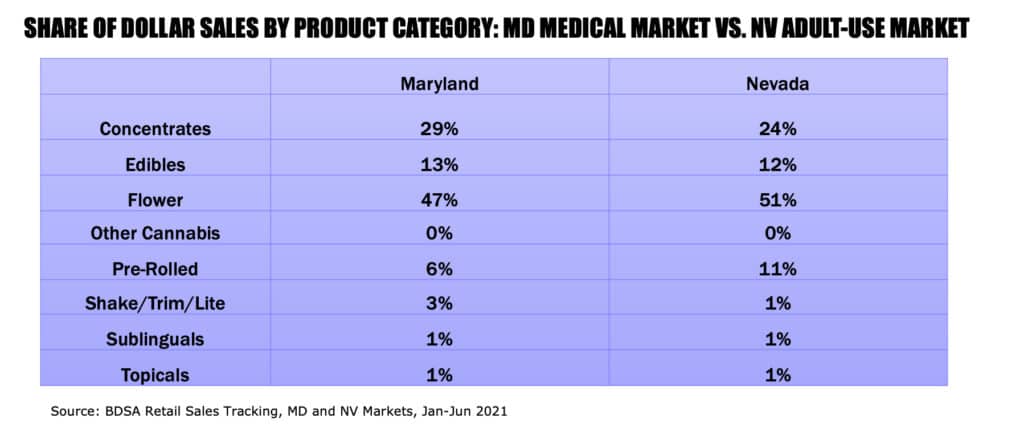

To illustrate this point, let’s take a look at the first half of 2021 in a medical only cannabis market, MARYLAND, versus a fully adult-use legal cannabis market, NEVADA. The brands, products, regulations, tourism, and consumer differ from Nevada to Maryland; However, from east to west, the market share by form factor is largely similar. The largest difference worth calling out is the strong pre-roll market in Nevada, whereas more of that share goes to flower in Maryland. Regardless, the markets show similar dollar sales by category. (Reminder, BDSA tracks dispensary retail sales down to the category, brand, product, and product attribute level by day, week, month, quarter, and year in 11 legal US cannabis markets: AZ, CA, CO, FL, IL, MA, MD, MI, NV, OR, PA.)

Key differences between different types of medical cannabis markets

While we don’t see big differences in consumer habits between medical and adult-use consumers, state medical markets aren’t created equal. Some states are home to medical programs that have more stringent regulations, only allowing access that is best described as “strictly medical.” In contrast, other states are home to medical markets that resemble adult-use markets. The differences between these two “buckets” of markets can be attributed to a number of regulatory factors:

Qualifying conditions

One key difference between these two types of markets is how expansive their qualifying conditions list is, with many markets in the “strictly medical” category limiting cannabis use to those with conditions like HIV/AIDS and cancer, while more permissive markets allow cannabis for a more expansive list of qualifying conditions, allowing for a larger and faster growing market.

Limited number of medical professionals who are able to recommend cannabis

States that restricted cannabis recommendations to primary care physicians saw slow growth, as many physicians are hesitant to put themselves at risk by recommending a Schedule I drug. By contrast, some of the medical markets that saw the fastest growth allowed a wide range of medical professionals to recommend cannabis, including doctors, nurse practitioners, and certain types of therapists.

Product restrictions

“Strictly medical” cannabis markets are more likely to restrict access to the most popular cannabis form factors, such as flower or infused foods. As these products have been phased into medical markets, sales and patient counts have seen a marked increase.

How medical markets are changing and growing

Some medical markets that have recently legalized are still home to many of these restrictions on products and qualifying conditions, but as time goes on, more states are loosening regulations on their medical programs. All but a few medical states now allow cannabis for PTSD and chronic pain, which has led to the largest boosts in patient counts. Further, restrictions on the most popular product, flower, have been rolled back across the country. These developments will allow more consumers to have access to legal cannabis, spurring consumer penetration, market growth, and oftentimes accelerating the move to adult-use.

So, it isn’t clear cut. BDSA finds that as legal cannabis markets grow and mature, cannabis sales by category look more similar than dissimilar. Further, cannabis consumption for most consumers is multi-faceted. Consumers seek products that provide them different benefits throughout the day, week, or month. They want to have a good cannabis experiences and seek functional benefits from the plant, and the benefits they seek include medical, wellness, and recreation.