BDSA recently announced the release of its 2020 cannabis sales data and forecast future sales by region.

“The cannabis industry faced numerous challenges in the past few years, none so potentially disruptive as the coronavirus pandemic in 2020,” said Micah Tapman, chief executive officer, BDSA. “Our previous forecast was conservative based on the expected economic fallout from the pandemic, but the industry not only survived, it thrived and legal cannabis gained considerable ground, exceeding our expectations in several markets.”

US and Global cannabis sales in 2020

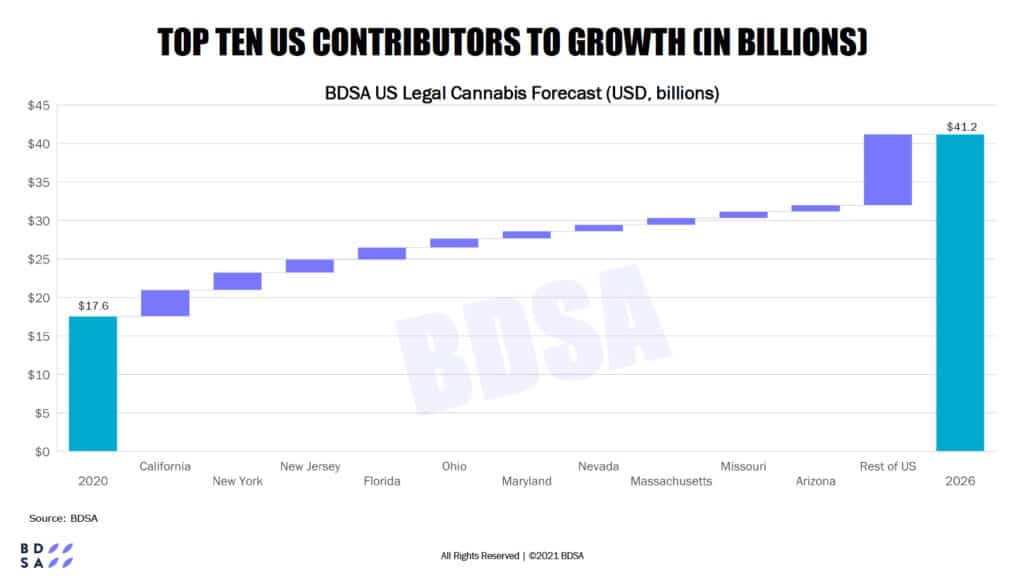

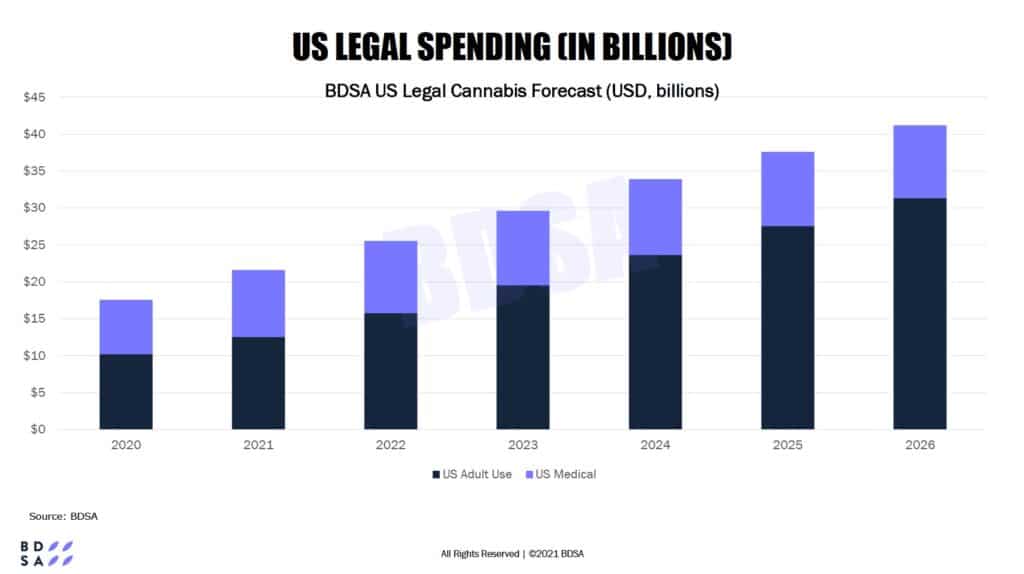

Legal cannabis sales in the US passed $17.5 billion in 2020, growth of 46% over 2019’s $12.1 billion. BDSA forecasts US sales to reach $41.3 billion in 2026, a CAGR of 15%. Global cannabis sales reached nearly $21.3 billion in 2020, an increase of 48% over 2019 sales of $14.4 billion. BDSA forecasts global cannabis sales will grow from $21.3 billion in 2020 to $55.9 billion in 2026, a compound annual growth rate (CAGR) of more than 17%.

Cannabis sales data by state in 2019 and 2020

Many markets (both new and mature) in the United States saw accelerated growth in 2020 –- Illinois, which launched adult-use last year, saw the largest dollar gain in 2020, rising by $784 million. Several other markets saw major expansion, the top four being California (+$586 million), Florida (+$473 million), Colorado (+$451 million) and Oklahoma (+$400 million). Colorado also grew by 26%, double its 13% rise in 2019, and Oregon expanded by 39%, versus 21% in 2019.

Even so, new markets are key to future growth. Medical and adult-use markets that launched in 2019 and 2020 contributed $1.6 billion in spending in 2020–$422 million in medical and nearly $1.2 billion in adult-use. Five new US markets legalized medical or adult-use cannabis during the 2020 elections: Arizona, Mississippi, New Jersey, Montana and South Dakota. These new legalizations bring the total population of states with medical cannabis to 241.1 million (71% of the country) and the total number of adults in adult-use states to 83.3 million (34% of the country.)

BDSA expects four new medical and five new adult-use markets to commence sales in 2021. Arizona has already become the first state to launch a new market in 2021, with the start of adult-use sales on January 22, 2021. This launch occurred much faster than any other state transitioning from medical-only to fully legal and will contribute to rapid expansion this year.

Cannabis flower and edibles sales in 2020

At the category level, flower continued to show strong performance in 2020 across many markets. This trend was especially strong in California, where flower expanded from a 34% share of sales in August 2019 (prior to the arrival of the EVALI crisis) to holding a 40% share of sales in January 2021. Part of 2020’s upsurge in flower sales is likely due to the pandemic, as many consumers who previously opted for more discrete products like vapes switched to flower while staying at home. The flower category is forecast to remain strong in the coming years and is expected to make up 39% of California sales in 2026.

Edibles saw sizable sales growth in key markets, particularly in Illinois as it transitioned to adult-use in January 2020, with edibles rising from a 15% share of legal sales in December 2019 to a 21% share in January 2020. Edibles share gradually dipped as the year progressed, totaling 16% of sales in December 2020, but the category is expected to have strong performance as the Illinois market develops, with BDSA forecasting edibles to take 20% of legal sales in 2026.

*These data reflect legal cannabis market forecasts. CBD market forecasts are also available for sale from BDSA and include CBD-dominant products (derived from marijuana or hemp) sold in dispensaries, pharmaceuticals, and CBD products in general retail (derived from hemp).

21 thoughts on “BDSA’s detailed cannabis sales data from 2020 and predicted market growth by 2026”

Pingback: Oregon cannabis tax proposals could cost cost over $100 million, threaten 2,800 jobs, and strangle small retailers - MJ Brand Insights

Pingback: THE KEY RETAIL SEGMENTS FOR BRICK-AND-MORTAR GROWTH | CBC Atlantic

Pingback: When to Buy Pot Stocks? – Massive Returns

Pingback: When to Buy Pot Stocks? – Equity Analyst Report

Pingback: When to Buy Pot Stocks? – Finance 4 Conservatives

Pingback: When to Buy Pot Stocks? – Daily Money Reports

Pingback: When to Buy Pot Stocks? | Incredible Returns

Pingback: When to Buy Pot Stocks? – Trading Pulse

Pingback: When to Buy Pot Stocks? – Global Cash News

Pingback: When to Buy Cannabis Stocks? – Financial Investment Blog

Pingback: When to Buy Pot Stocks? – The Retirement Savers

Pingback: When to Buy Pot Stocks? – USA Market News

Pingback: When to Buy Pot Stocks? | Expert Trader News

Pingback: When to Buy Pot Stocks? – Weekly Market News

Pingback: When to Buy Pot Stocks? – The Wall Street Today

Pingback: When to Buy Pot Stocks? – Traders Wealth

Pingback: When to Buy Cannabis Stocks? - Cannabis News TV

Pingback: When to Buy Cannabis Stocks? - The Money 360

Pingback: When to Buy Cannabis Stocks? - Investor News Today

Pingback: The Key Retail Segments for Brick and Mortar Growth

Pingback: THE KEY RETAIL SEGMENTS FOR BRICK-AND-MORTAR GROWTH - CBC Atlantic Retail