Cannabis professionals tasked with building long-term brand equity and customer loyalty face a daunting task. Each state and province in North America represents a distinct market with unique and ever-changing regulations and competitive environments. Each is at a different stage of maturity, with trends and patterns forming and dissolving at a rate that makes market data obsolete within months. Research into consumer preferences blurs the lines between dramatically different markets, producing scattershot results that leave even well-funded teams in the dark.

So what’s a cannabis brand to do? Is the best strategy to target the highly-competitive “red ocean” of existing cannabis enthusiasts? Or do you sail into the clearer blue waters where your gut and market research suggest there may be an unmet need? Without question there’s a huge market of new consumers ready to begin their cannabis journey, but what do they want, and how will their preferences evolve?

The cannabis industry humbled me, and forced me to rethink many of the benchmarks and best practices in my toolkit.

I’ve worked on the front lines of legal cannabis for the last five years, participating in brand and product launches across nine different states or provinces in the US and Canada. Before joining the cannabis industry, I worked for Starbucks as a Vice President responsible for retail operations, new concept development, and international expansion. I know how to build brands, launch products, and drive sales in traditional consumer product markets. The cannabis industry humbled me, and forced me to re-think many of the benchmarks and best practices in my toolkit. Over the last five years I’ve observed four consistent trends in consumer preferences and purchasing behavior across maturing markets in North America.

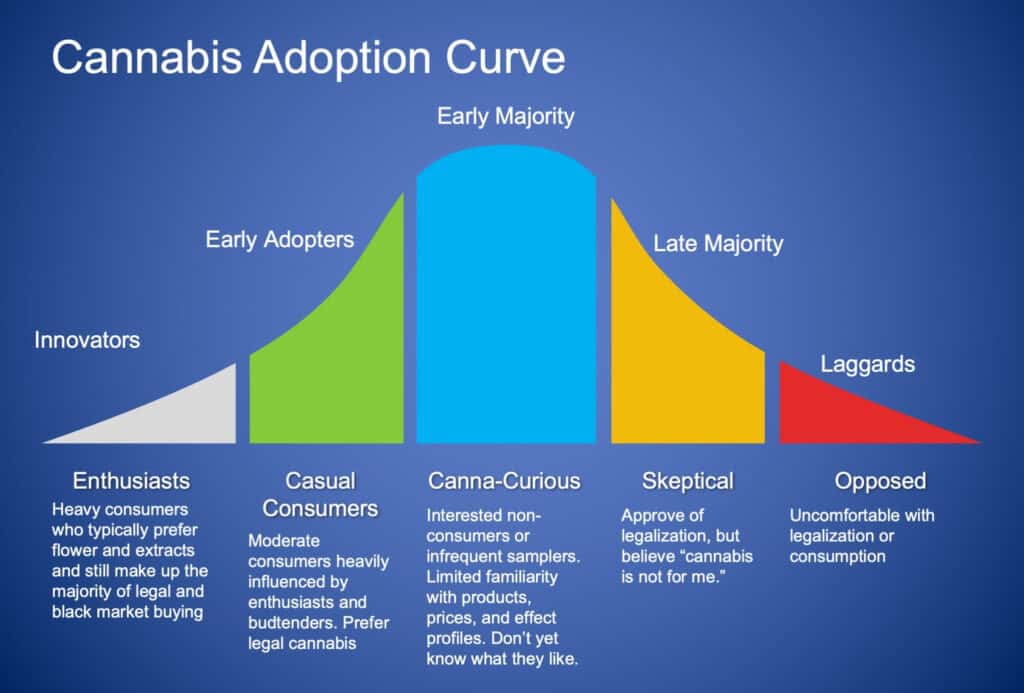

These trends fit a classic model that provides context for understanding and predicting the cannabis customer life cycle: The Consumer Adoption Curve. This time-tested model describes the way new products and behaviors spread through our culture. Smart phones, organic foods, and even abstract ideas (like approval for cannabis legalization) follow the same pattern: Popular acceptance builds support among a loyal few, which swells until it tips into the mainstream, eventually gaining broad acceptance as the new normal.

Understanding how the adoption curve applies to the cannabis industry is critical when choosing your target customer and predicting their evolving preferences. The end goal is to design and deliver an experience that delights existing customers while also appealing to the next wave of potential customers who are still unsure whether your brand is right for them.

According to a recent survey in US states that have legalized recreational cannabis, 36% of adults 21+ are current consumers (compared to 29% nationally). An additional 33% are accepting of legal cannabis, but have not consumed within the past six months. This tells us that while recreational cannabis has achieved mainstream acceptance, we have not yet reached the tipping point where a majority of US adults are active consumers. (For comparison, 54% of adults have recently consumed beer, wine or spirits.)

Cannabis brands that target the cannacurious appeal primarily to non-consuming segments at their own peril. They risk finding themselves with neither a current base of customers, nor credibility with the existing enthusiasts who drive the success of new products and influence those further along the adoption curve.

Cannabis markets, competitive environments, and consumer preferences evolve rapidly following legalization in each unique market. When we understand historic trends in cannabis adoption across mature markets, we gain a powerful guide to future success.

New consumers follow historic consumption patterns regardless of cultural affiliation.

New consumers may not embrace everything they see in cannabis culture, but all consumers, from the cannacurious to the self-identified stoner, are heavily influenced by that culture and its trends. The “experts” in the market are the enthusiasts, budtenders, and home growers who have access to the widest range of products, and sufficient product education and cultural expertise to make confident buying decisions. With regulations limiting traditional consumer marketing and acquisition strategies, new customers often base purchase decisions on one of the following:

- Product popularity and the wisdom of crowds – The bestsellers today are those preferred by heavier or more frequent consumers. In surveys and focus groups, non-consumers or novice consumers consistently indicate a preference for ingestible over combustible formats. According to market data from Headset, combustible formats (flower, pre-rolls, and concentrates) outsell ingestibles (edibles, beverages, and tinctures) by a factor of 5-1 in the most mature licensed markets (WA and CO) over the last 24 months.

- Friends and family –According to a 2019 National Survey by the Canadian government, 39% of consumers received their cannabis from friends and family. Novice consumers seek the advice of those with more experience and knowledge about cannabis.

- Budtender recommendations – When facing a sea of unfamiliar options, customers rely on retail sales professionals (budtenders) who recommend products based on a combination of personal experience and popular demand.

All three of these decision drivers send new customers down the path of the traditional cannabis enthusiast and work AGAINST brands and products that target the “cannacurious” without also achieving credibility with existing consumers.

Customer education drives purchasing behavior.

- THC and CBD percentages are the most obvious measure of efficacy, and novice consumers AND less educated budtenders tend to focus on the THC “bang for your buck” offered by various products.

- After developing familiarity with the effects of THC and CBD, customers often turn to the Indica vs. Sativa classifications to dial in the desired effect profile, from sedating to stimulating. Cannabis science progressed past these classifications long ago, but most brands find shortcuts easier than customer education, and myths are persistent where regulations create obstacles to education.

(At the end of 2019, Leafly finally stopped categorizing strains by Indica/Sativa/Hybrid, writing that while these categories describe the appearance of the plant, they DO NOT predict how the strain will make the customer feel. The company debated this change internally as far back as 2015, but avoided moving until they believed that the broader market was ready to embrace more accurate but complicated concepts. Brands and marketers still relying on these confusing and outdated categories are missing an opportunity and risking their own credibility.)

- More sophisticated customers, budtenders, and cannabis brands no longer focus on THC or Indica/Sativa, but instead on quality indicators like aromatic profile. Terpenes play a starring role in driving both the perceived potency and the unique effects of different strains of inhaled cannabis. In the end, our own senses (smell in particular) are by far the best indicators of product quality, and different people respond in different ways to the same strains and terpene profiles. When combined with personal experience, a strain’s aroma can be the most reliable predictor of its effects. Developing a personal palate for cannabis is the only way to consistently select the right product to deliver a desired effect.

I worked with a cannabis retail chain in Washington State from 2015 to 2018, and watched the steady trend of customer conversations follow this well-worn path of product education. I saw this same trend play out at a far faster pace following the opening of adult-use retail stores in Canada at the end of 2018. The speed at which customers are educated (and change their purchase behavior) increases as more consumers become “experts,” and more brands build marketing around modern cannabis science instead of perpetuating lingering myths from the days of prohibition.

Consumer preferences evolve predictably with consumption habits.

- In focus groups and surveys, non-consumers typically express a distaste for “smoking” and a preference for ingestibles, disposable vapes, “discreet” product formats, and low potency products.

- Influenced by expert recommendations and personal experience, casual consumers who become repeat customers often develop loyalty to a handful of brands or products that deliver a consistently positive experience. Customers may stay in this safe zone long-term even if the frequency and amount they consume stays low.

- As consumption and tolerance increase, consumers tend to move away from ingestibles, low-end vapes, and “discreet” products. In addition to being more expensive per dose/serving, these products are also less effective than inhaled cannabis, thanks to terpenes and other compounds that add depth to the cannabis experience and make up the entourage effect. Many consumers who are unaccustomed to THC, or who consume infrequently, will find a 5mg mint “very effective” despite the low dose and lack of complexity.

- As consumption of terpene-rich flower and extracts increases, enthusiasts delight in trying new brands, products, and strains. Now comfortable with larger doses of THC, they confidently explore the world of cannabis and develop strong preferences based on personal experience. (Frequent consumers rarely display the brand and product loyalty found in beverage alcohol. This is due in part to the inconsistent, small-batch nature of cannabis, and in part to the body’s tendency to become less sensitive to repeated exposure to a specific strain or terpene profile.)

Cannabis brand loyalty is driven by authenticity, credibility, and trust.

In a highly regulated market where product brands lack direct marketing access to consumers, and sensory shopping is limited by packaging regulations, budtenders and informed friends have the greatest influence over brand/product perceptions and purchase behavior.

You may be able to design a product and packaging combination that scores beautifully in focus groups with uneducated consumers and the cannacurious, but if budtenders and enthusiasts don’t buy your story and believe in your product, it won’t sell.

This does not mean that all products should be formulated for heavy consumers with high tolerance. All too often cannabis marketers try to position low-quality products as premium based on nothing more than an aspirational brand. This is a mistake. Even if your cannacurious target consumer doesn’t know any better (yet), their friends and local budtenders probably do know better. A distillate vape cartridge may be “ultra-pure”, but that doesn’t make it premium .I could market ethanol as “more pure” than wine or whisky, but even a great marketing campaign wouldn’t make it sell.

For example, I had the opportunity to consult on what went wrong with a premium brand and product rollout in California that was backed by a multi-million-dollar marketing budget. My client launched the product in nine high-volume stores and offered significant marketing support, training, and cash incentives to encourage budtenders to promote the brand. I toured the market after launch. When asked about this very high-profile brand, budtenders aggressively sold AGAINST the brand, sharing that while the products were “good”, they did not warrant the premium price point. This was the case in eight of the nine stores. With budtenders actively discouraging purchase, sales were terrible. In my experience, budtenders are not automatically opposed to high-profile brands and slick marketing, but “corporate cannabis” pays a particularly high price when cultural tastemakers determine a brand to be inauthentic and untrustworthy.

So let’s review the trends:

- New consumers follow historic consumption patterns regardless of cultural affiliation.

- Customer education drives purchasing behavior.

- Consumer preferences evolve predictably with consumption habits.

- Authenticity, credibility, and trust drive cannabis brand loyalty.

I’ve seen these trends combine in predictable ways over the past five years. For example, focus groups of likely customers who are not current cannabis consumers are often worthless.

The preferences of a curious potential customer begin to change as soon as they enter a real store with real products, prices, and expert budtenders providing even basic information. They ABSOLUTELY change when experiencing their own body’s unique reaction to different products and strains.

There is no corollary in beverage-alcohol to the tremendous range of physical and cognitive effects found in cannabis. Customer education also plays a very different role. In cannabis, marketing doesn’t have as much influence over the customer as it does in other consumer products. Cannabis will impact your mood more noticeably than even the boldest shade of lipstick.

A dab rig looks like hardcore, scary drug paraphernalia to many people. A bit excessive with the torch and all, right? The cannacurious customer rarely enters the market wanting to buy a dab rig or expensive extracts to go in it. But once you learn to see past the buzz of THC, the difference in flavor and effect between a distillate vape pen and live rosin on a rig becomes impossible to forget. Suddenly dabbing feels more like brewing a precious gyokuro in a handmade Japanese teapot. Building your brand and products around the preferences of curious non-consumers is like doing focus groups for a new sports car design with people who have never driven before. Many of the shapes in the design of a sports car stir visceral memories and feelings, but only in those who have experienced the thrill of driving fast.

I’ll close with a real-world example of how these trends combined in Canada in 2019. I spent most of the year in licensed Canadian retail stores and the offices of adult-use brands. My first question to budtenders was always, “Which brands have the best flower?” I also spent some time developing familiarity with black-market players and culture in Vancouver, Calgary, and Toronto. These deeply credible tastemakers would routinely make fun of any branded swag I had picked up along the way, while they themselves sported gear from 7ACRES. As far as I can recall, 7ACRES was the first (and for a long time only) adult-use flower brand to skip over THC potency and Indica/Sativa and start the budtender and customer education conversations with terpenes. Their slogan is “Respect the Plant.” Their marketing is explicitly targeted to enthusiasts. As the year progressed, I heard more and more budtenders in licensed stores answer my question about the best flower by pointing me to 7ACRES.

In 2019, 7ACRES won “Craft Grower of the Year” at the Grow Up Awards, “Brand of the Year ” at the Canadian Cannabis Awards, and their “Respect the Plant” campaign won “Best Marketing Campaign” at the O’Cannabiz Awards. By building a brand that was credible to the cannabis enthusiasts who predated legalization, and investing in customer education, 7ACRES placed themselves squarely in the path of evolving consumer preferences for legal cannabis. By contrast, NOVA Cannabis (one of the first large retail chains backed by one of the largest licensed producers) installed graphics in more than 20 stores proclaiming that “INDICA more commonly contains higher CBD to THC ratios which may be suitable for the evening, when relaxation is desired.” That’s not a typo – it’s just plain false, and an epic credibility gap. Last month, Aurora Cannabis sold off its stake in NOVA’s parent company Alcanna, locking in nearly an 80% loss on their CA$138 million investment in two years.

In the end, cannabis brands would do well to hire marketers and leaders who are themselves cannabis enthusiasts, who understand the product and the consumer, and who can apply a critical eye to the mountains of confusing market research and conflicting data coming out of this highly fragmented and inconsistent industry.

Without question, cannabis companies need experienced, professional leadership. The most successful leaders will approach this industry with humility and curiosity. The past offers a map to the future. It’s time more of us learned and applied the lessons!

Special thanks to Jackson Holder for helping to inform and refine these trends and insights.

3 thoughts on “The cannabis consumer adoption curve: Building iconic brands in an evolving market”

Pingback: MJ Unpacked Midwest: Day Two Takeaways - MJ Brand Insights

Pingback: Trend Watch: The move toward "premium" products - MJ Brand Insights

Pingback: A Game of Recalls and Cannabis: The Effects on Brand Equity in a Rapidly Evolving Industry • TrimForce