Brand loyalty in cannabis is a relatively new thing. As anyone in the industry can tell you, cannabis brands have been hampered by social media bans, restrictions on advertising, packaging restrictions, and other (sometimes absurd) regulatory hurdles. It varies from state to state and country to country, but it’s never easy for cannabis brands to connect with consumers. So companies have to get creative to build brand loyalty. Some brands have a big PR budget, others have a built-in hook like a celebrity owner. Smaller brands have to think harder and work harder to get attention.

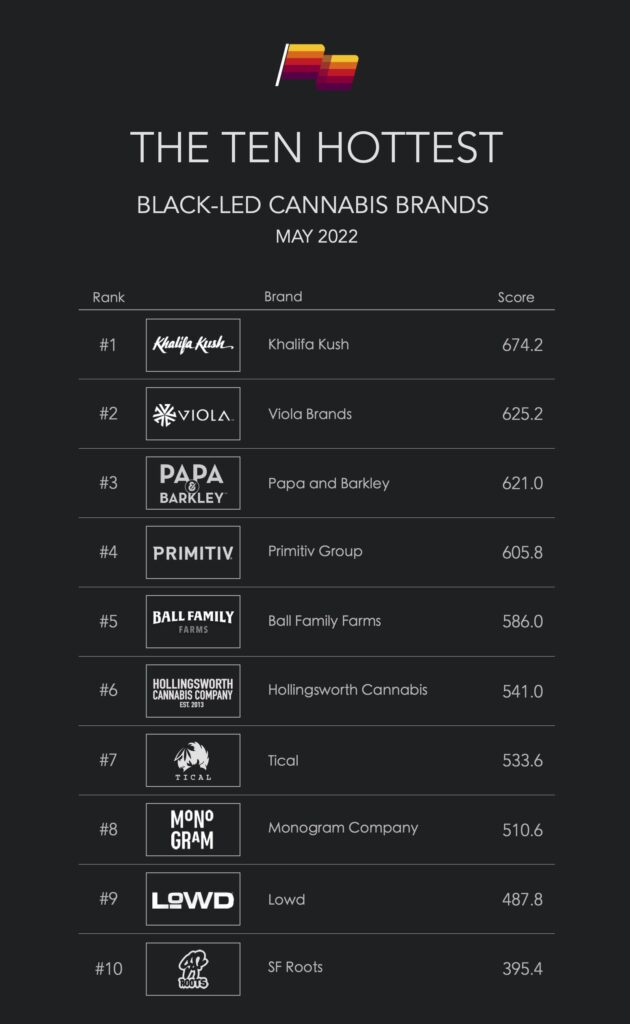

This article is part of an ongoing series. Each month we take a look at a category of cannabis brands and, with data from our friends at Pioneer Intelligence, pinpoint the ten brands that are killing it when it comes to consumer engagement. In this case, “hottest” refers to brands that are currently generating the most buzz, as measured by the Pioneer Intelligence Heat Index, which monitors consumer engagement across three pillars: earned media, social media, and web traffic. Pioneer gives slightly more weight to brands that have seen a recent uptick in activity. For example, a brand that has significantly increased its social media followers could qualify as “hotter” than a giant brand that already had a giant following, but has not seen notable recent growth. More on Pioneer’s methodology here.*

This month’s list is interesting to me for a number of reasons, but most notably because of the mish-mash of massive brands and smaller operators. Because there are relatively few Black-owned cannabis brands, there’s room on a nationwide top ten list for authentic grassroots brands such as The Hollingsworth Cannabis Company and SF Roots.

It’s beyond cool to see these smaller companies on the list, but there’s a shadow to that story. While my preference is always with family-owned cannabis companies, if large MSOs exist, then clearly there should be more that are Black-led. That said, congratulations to everyone at Ball Family Farms, THC, and SF Roots for making some noise. To find out what these smaller brands are doing to compete for consumer attention with the likes of Wiz Khalifa and Jay-Z, we reached out to a few people, starting with Joy Hollingsworth, co-founder of The Hollingsworth Cannabis Company, the only Black-owned cannabis farm in Washington state, and asked her about their consumer engagement strategy. Joy replied with typical frankness: “We actually don’t have a strategy as we’re just focused on continuing to be authentic and capturing things that are happening without our daily lives.”

Joy noted that it’s challenging for growers to engage with consumers in Washington’s market, which is not vertically integrated. This problem was compounded when Instagram killed their original account, which represented what she describes as “amazing, authentic relationships.” This was a painful blow. “It took us years to build that out and we were devastated when it was suspended,” she said.

Despite these obstacles, Joy and her brother Raft have earned significant media attention for their ongoing fight to lower the barrier of entry for equity applicants, and they no doubt generate web traffic and engagement by providing a very cool assortment of resources for aspiring entrepreneurs including the podcast Be Good Daily, with “educational information about new ways for BIPOC community to participate within the cannabis industry.”

While not exactly a small company (they have around thirty employees and are expanding into Oklahoma), Black-owned California cannabis brand, Ball Family Farms was built from the ground up by Chris Ball, who started out selling eighths on the illicit market. When asked which type of consumer engagement he values most, Chris said, “We value all different types of consumer engagement; for us, it’s a balance between avenues, not one particular thing.” Ball says that while social media is useful and press attention is validating, you can’t beat human interaction.

Ball Family Farms

“The essential consumer engagement for us is the personal and in-person engagement through the events we participate in, our newly relaunched budtender education platform and fans we often meet on the street,” he said. “As a legacy operator, I know you can’t overvalue personal connections with your consumers. And I think that’s one of the ways we’re unique. It’s a balance.”

We asked Ball if he’s switched up his strategy or if he can think of anything they’ve done lately that might be generating some heat on the web.

“We haven’t changed much, which is encouraging,” he said. “It’s nice to know what we are doing is working. But one of the things we’ve expanded is our budtender education program. It’s proving to be invaluable in training budtenders on how to speak about the brand and products. At the end of the day, I believe we continue to gain loyal followers because of what I’ve always said, product quality and consistency are key. (Plus, it doesn’t hurt that we have exclusive genetic and grow methods unparalleled in the market!)”

Amen to that. So, without further ado, the ten hottest Black-led or Black-owned weed brands nationwide…* Pioneer needs to track a brand for six months before they are eligible for inclusion in the index and a few of our favorite brands, like Calyxeum and Neighborhood Essentials, are still in the waiting period.

Pioneer Intelligence leverages data to benchmark marketing performance of consumer-facing cannabis brands. Built by a group of experienced and passionate marketers and data scientists, Pioneer helps industry stakeholders better understand how communications strategies resonate with audiences. In early 2021, Pioneer launched its first products, a suite of marketing performance scorecards. These reports present actionable data across three focus areas: social media, earned media and web-related activities. More information can be found on the company’s website, https://pioneer.buzz.

Disclaimer: Pioneer currently has more than 680 brands in their active pool with hundreds more in their pipeline. (Pipeline brands require six months of data before being added to the active pool.) Lists of both active and pipeline brands can be found at pioneer.buzz/brands. If you would like to request your brand be tracked by Pioneer, please email [email protected].