First coined as a code word by teenagers from San Rafael in their quest to find a lost cannabis crop, the term “420” and the eponymous April holiday it spawned have been fixtures of cannabis culture for decades. Thus it seems appropriate to dig into some historical data. BDSA has identified five trends that brands and retailers can expect on the most important cannabis holiday of the year.

Expect store traffic and sales to spike the weekend before the 4/20 holiday.

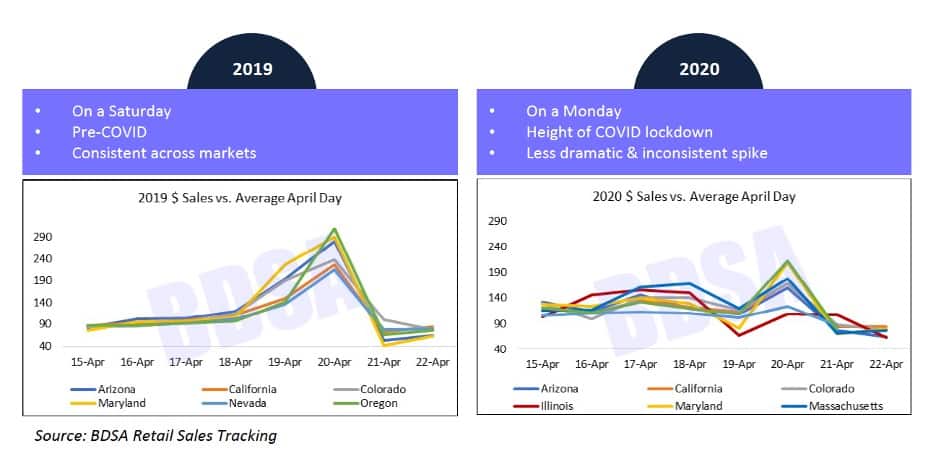

Across most markets tracked by BDSA, 4/20 and the preceding day are among the top sales days in the year–often over two times the annual daily sales average. We also see that day of the week matters. In 2019, when 4/20 fell on a Saturday, sales in California and Colorado on the preceding Thursday and Friday were higher than on an average Thursday and Friday for the rest of the year. 4/20 occurred on a Monday in 2020, and while the uptick in sales was less dramatic, the holiday happened at the height of Covid-19 stay at home orders, which no doubt had a negative impact on store traffic.

This year holiday sales patterns are expected to trend toward what is more typical for 4/20, and with the holiday falling on a Tuesday, we anticipate that the prior weekend will likely show an increase in daily transactions.

Expect a higher sales impact than last year.

While Covid-19 is still a huge concern, things are looking up: daily vaccination rates are exceeding three million, vaccine eligibility has been expanded, and the weather is warming. These factors, combined with pandemic fatigue and loosening restrictions across the country, suggest increased activity in the coming weeks and months – including on 4/20. The fact that the holiday falls on a Tuesday during an ongoing pandemic suggests that sales will not top 2019 totals, but they should exceed 2020 sales, when stay-at-home orders issued in March led many to stock up on cannabis, which in depressed sales in April.

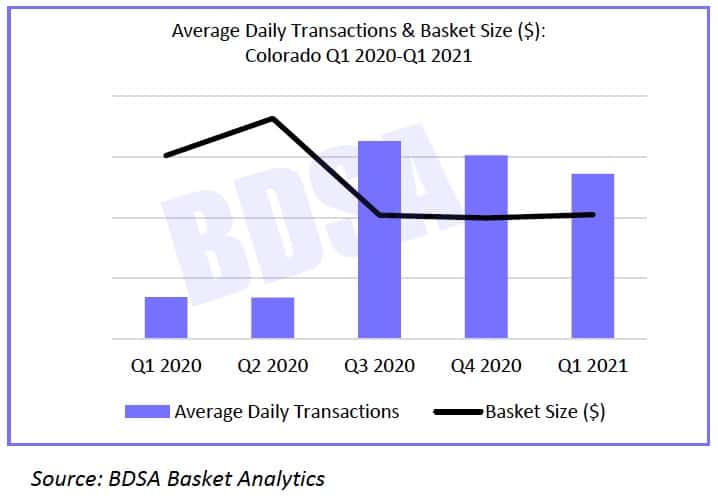

For reference, historical data from mid-pandemic shows that sales began to rebound beginning in late May (as cases began to fall in warmer months), leading to significant growth. In Colorado, average daily transactions were down through much of Q2, but began picking up steam going into Q3 as basket size correspondingly decreased as consumers saw less of a need to stock up. This “rebound” behavior could foretell a huge surge for this year’s 4/20 and the subsequent months, as conditions around the pandemic continue to improve and optimism rises.

The holiday’s impact will be more pronounced in “legacy” markets and less pronounced in those dependent on tourism.

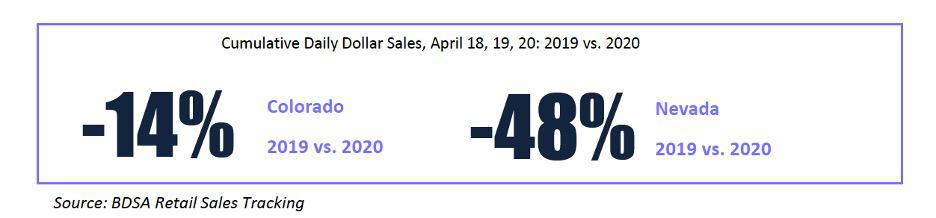

Comparing mature markets such as Colorado with tourism-dependent markets like Nevada, the magnitude of the pandemic’s impact on 4/20 last year looks quite different. While sales declined across all markets when comparing the 2019 holiday to 4/20 2020, Colorado took a relatively light hit, with combined daily sales for April 18-20 down 14% compared to Nevada’s 48% sales decline. With tourism and travel still in a depressed state, 4/20 sales surges are expected to be more pronounced in markets that are less reliant on tourism as a major sales driver. Retail sales tracking data also suggests that developing markets in states without a “legacy” cannabis scene, such as Illinois, see less of a sales boost around April 20.

Be prepared for price discounts and increases in store traffic, transactions and unit sales.

On the days surrounding the 4/20 holiday, discounts and in-store promotions historically drive down prices across categories. These price drops are offset by an increase in traffic and overall transactions, but BDSA data shows that sales unit volume tends to increase by a greater magnitude than actual dollar sales during 4/20 and preceding days.

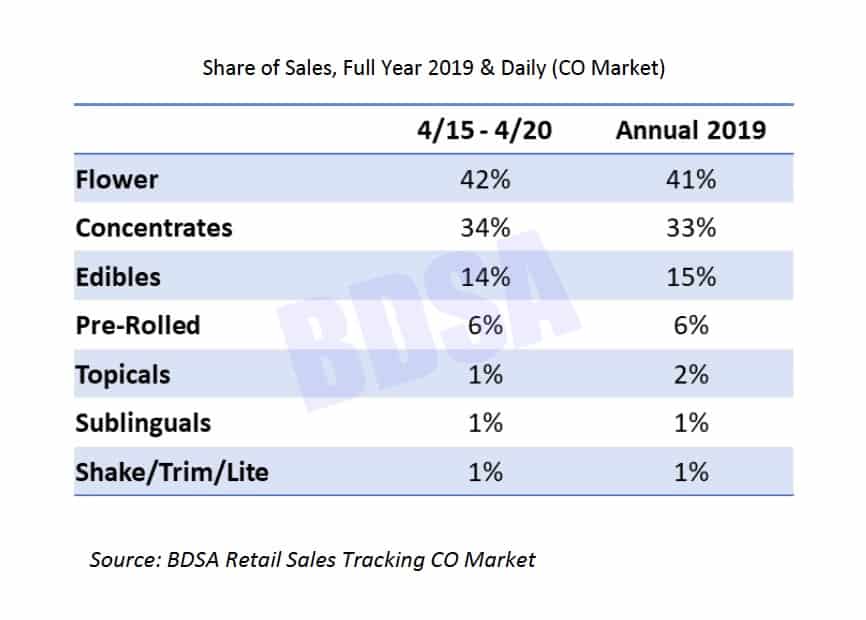

The 420 boost will be felt across all categories.

It makes sense to assume that all product categories will be impacted. While sales volume increases overall throughout the days leading up to April 20, the source of the volume does not change dramatically. In other words, the typical proportion of sales by category tends to stay the same.

While the pandemic still threatens, the light at the end of the tunnel has begun to shine for many. Pandemic response measures played a significant role in depressing sales around 4/20 last year, but cannabis markets have been on the rise since last summer and consumer optimism is growing. Signs point to a base of cannabis consumers excited to celebrate 4/20, leading to huge sales potential in the coming days.